Liftr Insights Report Reveals Tariffs Are Reshaping Semiconductor Investment and Valuations

Liftr Insights Report Reveals Tariffs Are Reshaping Semiconductor Investment and Valuations

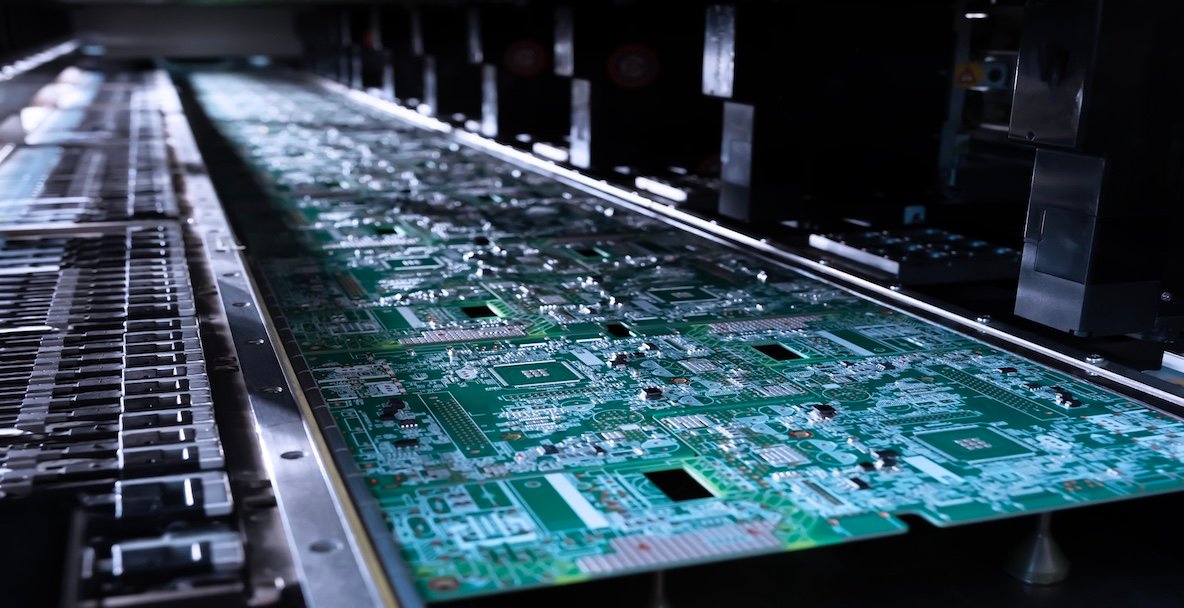

Amid escalating U.S. tariffs and intensifying geopolitical tensions, Liftr Insights, a leading provider of alternative data analytics for the cloud, AI, and semiconductor industry, has created a tariff report detailing how trade policies are reshaping global supply chains and investment strategies in the semiconductor sector.

Geo-Fragmentation and the Server Semiconductor Investment Landscape Report Key Findings by Liftr Insights:

Financial Services Repricing Risk

U.S. tariffs are forcing financial institutions to recalibrate risk models for semiconductor firms. Companies with diversified supply chains and domestic fabs are commanding premium valuations, while those exposed to tariffed regions face margin compression and capital flight. Liftr Insights data supports short- and long-term investing strategies so financial services can more accurately recalibrate their risk models due to tariffs.

"Our alternative data shows a clear bifurcation in semiconductor investment flows. Tariffs are no longer just a trade tool—they're a valuation driver," says Tab Schadt, CEO of Liftr Insights. "Investors need to understand the geopolitical chessboard to navigate the next wave of semiconductor growth."